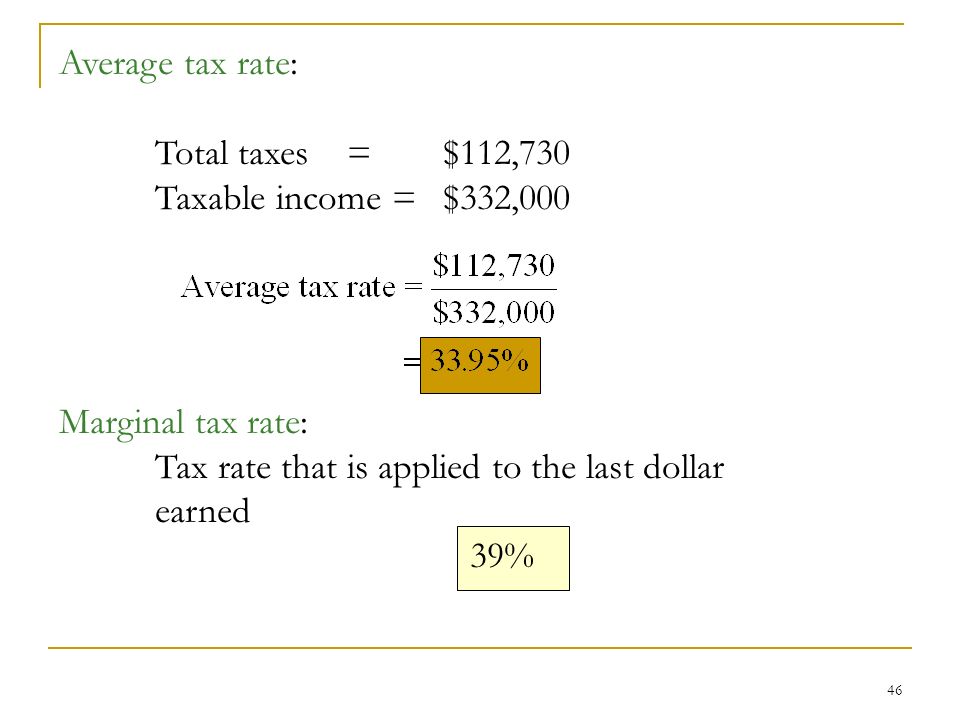

Average tax rate formula

Relevance and Uses of Average Formula. Each employers tax rate may vary from year to year depending on previous experience with unemployment and the rate schedule in effect.

Effective Tax Rate Formula Calculator Excel Template

Read more are bifurcated into seven brackets based on their taxable income.

. For both there is a similar formula only with variation in considering variables. This lets us find the most appropriate writer for any type of assignment. Let us see an example to understand it.

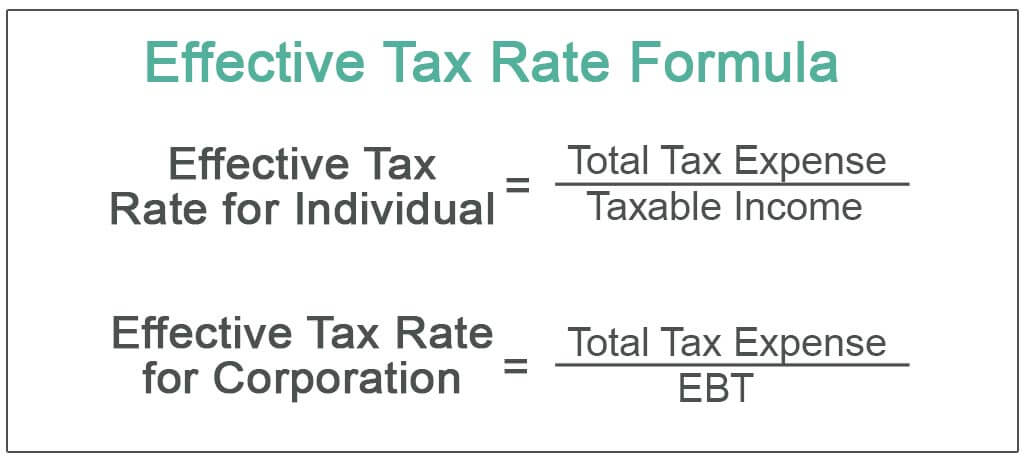

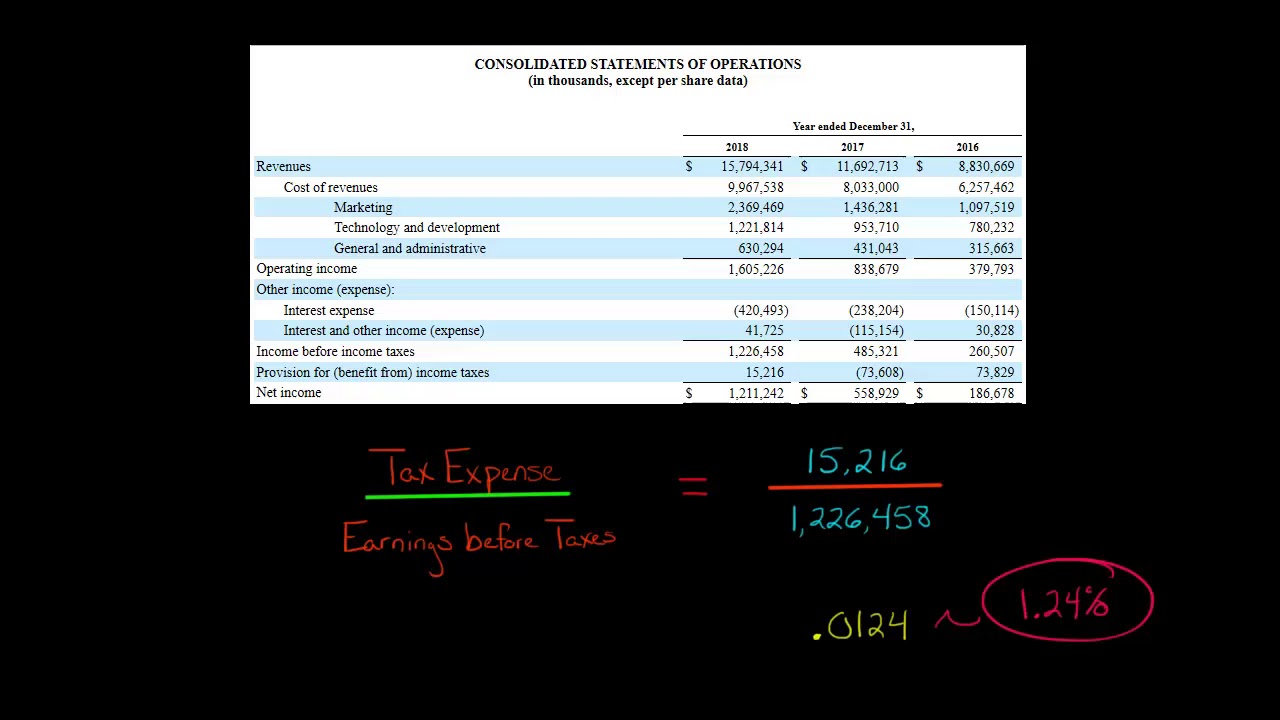

We can easily find the effective tax rate Effective Tax Rate Effective tax rate determines the average taxation rate for a corporation or an individual. Where t is. In this formula any gain made is included in formula.

Many companies and organizations use average to find out their average sales average product manufacturing average salary and wages paid to labor and employees. Average Rate of Return 1600000 4500000. A Microsoft 365 subscription offers an ad-free interface custom domains enhanced security options the full desktop version of.

John joined a bank recently where he earns a gross salary of 200000 annually. Rate of Return Formula Example 3. The nominal rate is the stated rate or normal return that is not adjusted for inflation.

Marginal Tax and Flat Tax Rate. Mortgage rates fluctuated greatly so far in the third quarter of 2022 with the average 30-year fixed rate swinging from 570 at the end of June to 513 on Aug. WACC Formula EV Ke DV Kd 1 Tax Rate 726.

The incremental tax rate 15 on 28625 and 25 on 42050 is basically the marginal tax rate. Using the example above Sarahs effective tax rate would be. A complicated 2011 mathematical formula was replaced starting in 2012 with a simpler inverse-linear formula with cutoff values.

In fact according to recent analysis by the Joint Committee on Taxation the 2017 tax bill cut the average rate that corporations paid in half from 16 percent to less than 8 percent in 2018. If you look at the weighted average formula you would see that the value is being multiplied by the right amount of weight and that is the beauty of the wt average. Material Changes 1 The following IRM sections have been added to incorporate the provisions of Interim Guidance Memorandum SBSE-04-0915-0056 Interim Guidance on Access to Suspicious Activity.

Weve developed a suite of premium Outlook features for people with advanced email and calendar needs. The tax rate on every bracket is the statutory tax rate. 18 according to Freddie Mac.

Average 60520 5. If an individuals gross income is 100 and income tax rate is 20. The formula for the real rate of return can be used to determine the effective return on an investment after adjusting for inflation.

In the US taxpayers Taxpayers A taxpayer is a person or a corporation who has to pay tax to the government based on their income and in the technical sense they are liable for or subject to or obligated to pay tax to the government based on the countrys tax laws. The tax base is calculated annually and is equal to 66 23 percent of the average annual wage for Nevada employees. A flat tax rate is exactly what it sounds like.

Take the annuitys current value minus your contribution then divide that. The average rate of return will give us a high-level view of the profitability of the project and can help us access if. The Treasury Department 2020 estimated that the average Federal individual income tax rate of the highest-income 01 percent of families in 2021 would be 23 percent and the Tax Policy Center.

For example if we need to find out the average of 10 13 and 25 on a simple average we will add three numbers and divide it. Under this formula taxes to be paid are included in the base on which the tax rate is imposed. A 90 percent of the first 996 of average indexed monthly earnings plus.

4104 Examination of Income Manual Transmittal. Our global writing staff includes experienced ENL ESL academic writers in a variety of disciplines. Purpose 1 This transmits revised IRM 4104 Examination of Returns Examination of Income.

Total Rate of Return. Notice in the Weighted Average Cost of Capital WACC formula above that the cost of debt is adjusted lower to reflect the companys tax rate. An investor purchase 100 shares at a price of 15 per share and he received a dividend of 2 per share every year and after 5 years sell them at a.

Tax Rate 2083. The marginal tax rate on income can be expressed mathematically as follows. Average Rate of Return 3556 Explanation of Average Rate of Return Formula.

Tax rate 329. The total rate of return tells you how much your annuity contribution has increased while the compound annual growth rate is the average amount is grew each year. All the latest news views sport and pictures from Dumfries and Galloway.

Get 247 customer support help when you place a homework help service order with us. A marginal tax rate. By CBO calculations the household incomes in the first and second quintiles have an average total federal tax rate of 10 and 38 respectively.

Its a single tax rate that is applied to all incomes regardless of the amount. Average 12104 Average sales for months is 12104. Marginal Tax Rate US.

For workers who turn 62 in 2021 the PIA computation formula is. We bring you the best coverage of local stories and events from the Dumfries Galloway Standard and Galloway News. In addition a Gas Guzzler Tax is levied on individual passenger car models but not trucks vans minivans or SUVs that get less than 225 miles per US gallon.

The Corporate Average Fuel Economy. The rate of inflation is calculated based on the changes in price indices which are the price on a group of goods. We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply.

In this situation Sarahs effective tax rate would be 20 compared to her marginal tax rate of 50. For example a company with a 10 cost of debt and a 25 tax rate has a cost of debt of. To calculate the total rate of return of your annuity follow this simple formula.

In total they would pay 4500 or an 18 average tax rate. Like most states Nevada uses the Reserve Ratio formula to determine. So we can see that the effective tax rate is lower than the marginal tax rate but higher than the lowest bracket income tax.

Let us take the example of John to understand the calculation for the effective tax rate. HM Treasury is the governments economic and finance ministry maintaining control over public spending setting the direction of the UKs economic policy and working to achieve strong and.

Effective Tax Rate Formula Calculator Excel Template

Effective Tax Rate Calculator Top Sellers 52 Off Www Ingeniovirtual Com

Effective Tax Rate Formula Calculator Excel Template

Marginal And Average Tax Rates Example Calculation Youtube

Chapter 8 Accounting For Depreciation And Income Taxes Ppt Video Online Download

Effective Tax Rate Formula Calculator Excel Template

Chapter 01 Learning Objective 1 2 Marginal Average Tax Rates And Simple Tax Formula Youtube

Marginal Tax Rate Bogleheads

Effective Tax Rate Calculator Top Sellers 52 Off Www Ingeniovirtual Com

Effective Tax Rate Formula And Calculation Example

Effective Tax Rate Definition Formula How To Calculate

Excel Formula Income Tax Bracket Calculation Exceljet

How To Calculate The Effective Tax Rate Youtube

Marginal Tax Rate Formula Definition Investinganswers

Federal Income Tax Calculating Average And Marginal Tax Rates Youtube

/dotdash_Final_Tax_Equivalent_Yield_Nov_2020-01-c528a1d54d4f48f19113104ac3291de1.jpg)

Tax Equivalent Yield Definition

Income Tax Formula Excel University